PBAT Policy Advisory Council proposes FIRS, Customs and NIMASA merger

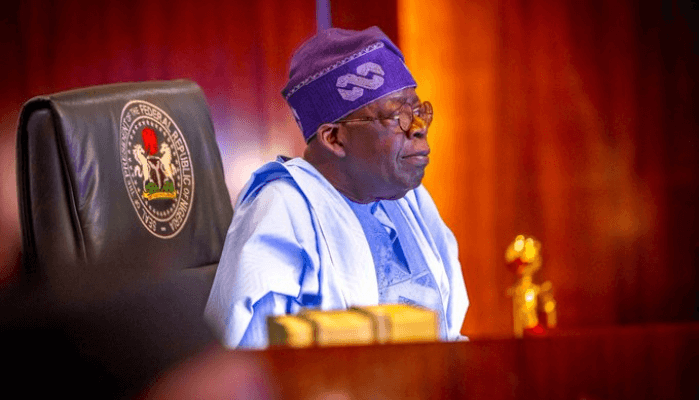

The imposition of a state of emergency on the country’s revenue collection has been advised by President Bola Ahmed Tinubu’s Policy Advisory Council.

In order to facilitate the effective collection of all direct and indirect taxes, as well as levies on behalf of the Federal Government, the council also suggested merging the Federal Inland Revenue Service, the Nigerian Customs Service, and the Nigerian Maritime Administration and Safety Agency into the Nigerian Revenue Service.

The National Economy Sub-Committee’s submissions state that the Emergency Economic Reform Bill, which would provide the President special authority to lead the economic reform agenda and promote the delivery of inclusive and sustainable economic growth, will help the policy.

The council further outlined targets to be pursued by the President in order to achieve some milestones within the first 100 days in office, including the elimination of fuel subsidies, sale or concession of certain government assets, change to a transparent and unified foreign exchange rate system, deepening tax collection, and optimization of operating expenditure to reduce costs.

Senator Tokunbo Abiru, who serves as the council’s chair, Dr. Yemi Cardoso, Sumaila Zubairu, and Dr. Doris Anite are all members. Our correspondent was able to receive a copy of the report that the panel had submitted on Friday.

The council’s report, which focuses on fiscal and monetary policies, industry, trade, and capital market reforms, stressed that adjustments to the Central Bank of Nigeria and temporary increases in fiscal circuit breakers like debt limits would aid in achieving N1 trillion in GDP growth and more than 50 million jobs for citizens in eight years.

The 90-page report also suggested that CBN changes will assist the central bank accumulate between $50 billion and $60 billion in foreign exchange reserves, with a minimum monthly input of $6 billion to $8 billion from export profits and other sources of capital inflow to support the policy at a N500–N600/$ exchange rate.

The council provided guidance on the fiscal policies that should be put in place, emphasizing the need to increase domestic refining capacity to two million barrels per day while fostering economic opportunity for the host towns.

As non-cash palliatives to lessen the impact of the elimination of fuel subsidies, they also recommended one-time personal income tax reliefs for low-income earners for up to one year.

The advice stated, “Grow crude oil revenue and savings into ECA and NSIA and ramp up production capacity from offshore and onshore assets to four million barrels within four years.

Related News “Formalize illicit refineries and support modular refineries to provide the host community with economic opportunity.

“In the next eight years, aggressively increase domestic refining capacity to 2 million barrels per day, including modular refineries.

“A policy directive that ensures proceeds from the sale of assets to settle existing FGN debt obligations” is one of the other fiscal suggestions that have been put out.

“List the stock prices of the lucrative and strategic NNPC businesses. To create liquidity in the short to medium term, privatize, concession, or sell down FGN’s ownership in corporate assets to partners and other investors (perhaps with a repurchase option) (with a focus on underperforming assets like NNPCL refineries).

Use blockchain to regionalize and concession the power transmission grid and develop and provide access to a government land register.

Additionally, the advisory committee suggested that, if necessary, the circulation of the old naira be extended until December 2024.

Additionally, it suggested gradually replacing the old notes with new ones through deposit money banks at a rate of 5% every month.

“Extend the December 31, 2023 deadline to December 31, 2024 (if necessary), and bring in new notes through the deposit money banks by 5% monthly and take out the old notes through the same 5% to solve cash shortage,” they stated.

“To transform Nigeria into Africa’s most effective trading nation, decongest the area up to 4km around the ports and designate them for cargo, roads, and railway, enforce the Presidential directive on 48hr clearance of goods at seaports in accordance with Executive Order 001, redefine the performance measures of key government agencies to emphasize trade facilitation, and set up a whistle-blowing mechanism that enables and empowers transporters to repo,” the policy continued.